Imagine you’ve saved up some money—maybe from a bonus, a side hustle, or just consistent savings—and you’re wondering, “What’s the best way to grow this?” Should you stick it in a fixed deposit, try your luck in the stock market, or explore something else? Enter mutual funds, a powerful investment tool that offers professional management, diversification, and flexibility to suit your financial goals. But with so many types of mutual funds in India, it’s easy to feel overwhelmed. Don’t worry! This 2025 guide breaks down the mutual fund types in simple, human-friendly language to help you pick the perfect fund for your needs.

Mutual funds pool money from multiple investors to invest in assets like stocks, bonds, or other securities. Each fund has a specific objective—some aim for long-term wealth creation, others focus on regular income, and some cater to goals like retirement or funding a child’s education. The variety of mutual fund types exists because every investor has a unique risk tolerance, investment horizon, and financial goals. The Securities and Exchange Board of India (SEBI) has neatly categorized them to facilitate easier decision-making. Ready to dive into the world of mutual funds? Let’s explore!

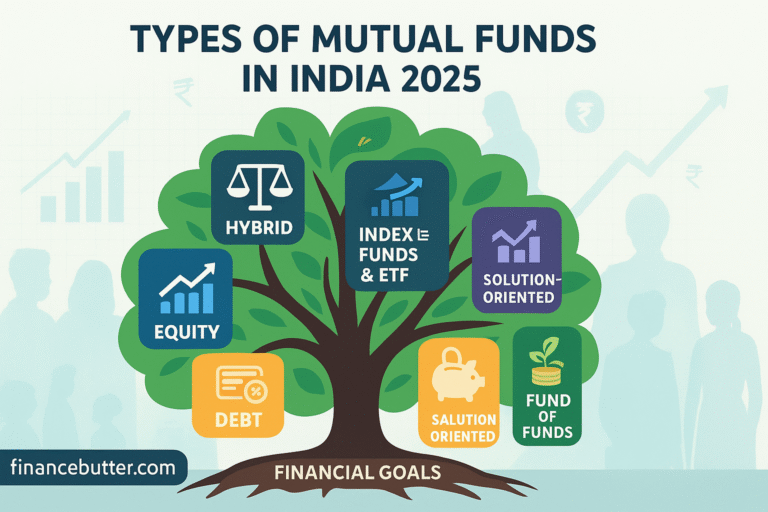

Broad Classification of Mutual Funds in India

In 2017, SEBI introduced a clear categorization system for mutual funds, which has been refined further by 2025. Funds are divided into five broad categories: Equity Funds, Debt Funds, Hybrid Funds, Solution-Oriented Funds, and Other Funds (like Index Funds and ETFs). Each category has sub-types tailored to specific investment needs. Let’s walk through each one, explaining what they are, who they’re for, and how they can help you achieve your financial goals.

Equity Mutual Funds: The Growth Engines

Equity mutual funds primarily invest in stocks—think companies like Reliance, TCS, or fast-growing startups. These funds offer high return potential but come with market volatility. If you’re young, investing for long-term goals (10+ years), and comfortable with some risk, equity funds are your go-to. Per SEBI rules, equity funds must invest at least 65% of their portfolio in equities.

Sub-Types of Equity Funds

- Large Cap Funds: These invest in the top 100 companies by market capitalization, like HDFC Bank or Infosys. They offer stable returns with relatively low risk. Best for: Conservative investors seeking growth without excessive volatility.

- Mid Cap Funds: These focus on companies ranked 101–250 by market cap. They’re growing businesses with higher return potential but more risk than large caps. Best for: Investors with a moderate risk appetite.

- Small Cap Funds: These target companies ranked beyond 250. They have high growth potential but also high volatility. Best for: Aggressive investors with a 7–10-year horizon.

- Multi-Cap Funds: These invest across large, mid, and small-cap stocks, offering balanced diversification. Fund managers have the flexibility to adjust based on market conditions. Best for: Investors seeking diversified growth.

- Sectoral/Thematic Funds: These focus on specific sectors (e.g., IT, pharma) or themes (e.g., ESG or green energy). They’re high-risk, high-reward. Best for: Investors bullish on a particular industry. [Want to dive deeper? Check our guide on Sectoral Mutual Funds for insights!]

Equity mutual funds, best equity funds 2025, large cap vs small cap funds.

Debt Mutual Funds: The Stability Champions

If market ups and downs make you nervous and you prefer steady returns, debt mutual funds are for you. These funds invest in bonds, government securities, or corporate debt, generating fixed income. They carry lower risk than equity funds but typically offer lower returns. They’re ideal for short-term goals (1–5 years) or risk-averse investors.

Sub-Types of Debt Funds

- Liquid Funds: These invest in short-term instruments (maturity up to 91 days) like treasury bills. They offer high liquidity and low risk. Best for: Parking money temporarily or building an emergency fund.

- Short Duration Funds: These invest in debt instruments with 1–3 year maturities. They provide moderate returns with low-to-medium risk. Best for: Short-term goals like buying a car.

- Long Duration Funds: These focus on bonds with 7+ year maturities. They’re sensitive to interest rate changes. Best for: Long-term investors seeking stable income.

- Gilt Funds: These invest in government securities with zero default risk. Best for: Ultra-safe investments.

- Corporate Bond Funds: These invest in high-quality corporate bonds, offering decent returns with moderate risk. Best for: Conservative investors seeking better returns than fixed deposits.

Debt mutual funds, best debt funds 2025, liquid funds for short-term goals.

Hybrid Funds: The Balanced Approach

Not too risky, not too safe—hybrid funds strike a balance by investing in both equity and debt. They’re perfect for investors who want growth with some stability. SEBI has categorized hybrid funds into six sub-types based on equity-debt allocation.

Sub-Types of Hybrid Funds

- Liquid Funds: These invest in short-term instruments (maturity up to 91 days) like treasury bills. They offer high liquidity and low risk. Best for: Parking money temporarily or building an emergency fund.

- Short Duration Funds: These invest in debt instruments with 1–3 year maturities. They provide moderate returns with low-to-medium risk. Best for: Short-term goals like buying a car.

- Long Duration Funds: These focus on bonds with 7+ year maturities. They’re sensitive to interest rate changes. Best for: Long-term investors seeking stable income.

- Gilt Funds: These invest in government securities with zero default risk. Best for: Ultra-safe investments.

- Corporate Bond Funds: These invest in high-quality corporate bonds, offering decent returns with moderate risk. Best for: Conservative investors seeking better returns than fixed deposits.

Hybrid mutual funds, aggressive hybrid funds, balanced advantage funds 2025.

Other Special Types: Funds for Unique Needs

Some funds don’t fit neatly into equity, debt, or hybrid categories. These special types cater to specific goals or strategies. Let’s explore them.

Index Funds & ETFs

Index Funds and Exchange Traded Funds (ETFs) track a specific index, like the Nifty 50 or Sensex. They’re passively managed, meaning lower expense ratios. At least 95% of assets are invested in index securities. Best for: Beginners or cost-conscious investors who want to grow with the market.

International Funds

These funds invest in foreign markets (e.g., US, Europe) for geographical diversification. Best for: Investors seeking global exposure.

Solution-Oriented Funds

These are designed for specific life goals, such as:

- Retirement Funds: For long-term wealth creation, with a 5-year lock-in or until retirement age.

- Children’s Funds: For funding education or other child-related goals, with a 5-year lock-in or until the child is a major.

Fund of Funds (FoFs)

These invest in other mutual funds rather than directly in stocks or bonds. At least 95% of assets go into underlying funds. Best for: Investors seeking diversified exposure without picking individual funds.

Index funds India, ETFs 2025, solution-oriented mutual funds.

SEBI Classification: What’s New in 2025?

SEBI’s 2017 categorization made mutual funds more investor-friendly, and by 2025, further refinements have enhanced transparency. Key updates include:

- Clear Naming: Fund names now clearly reflect their risk profile and strategy, avoiding vague terms like “opportunity” or “advantage.”

- Lock-in Periods: Solution-oriented funds (retirement, children’s funds) have mandatory 5-year lock-ins or until specific milestones.

- Asset Allocation Rules: Strict guidelines ensure clarity, e.g., equity funds must have at least 65% in equities, index funds 95% in index securities.

- MF Lite Framework: Introduced in 2024, this simplifies regulations for passive funds (Index Funds, ETFs), promoting low-cost investing in 2025.

These rules ensure transparency, helping investors choose funds aligned with their goals.

Which Mutual Fund Type Is Best for You?

The big question: Which fund is right for you? It depends on your risk tolerance, investment horizon, and financial goals. Here’s a quick guide:

- Beginners: Start with Index Funds or Large Cap Funds. They’re low-cost, low-risk, and offer steady market-linked growth. [New to investing? Check our Beginner’s Guide to Mutual Funds!]

- Short-Term Goals (1–3 years): Liquid Funds or Short Duration Debt Funds are ideal for safety and liquidity.

- High Risk Appetite: Small Cap Funds or Sectoral/Thematic Funds offer high return potential but come with volatility.

- Balanced Approach: Hybrid Funds (especially Balanced Advantage) provide a mix of growth and stability.

- Specific Goals: Retirement Funds or Children’s Funds are great for long-term planning.

Pros & Cons of Each Mutual Fund Type

Every fund type has its strengths and weaknesses. Here’s a breakdown:

Equity Funds

- Pros: High return potential, ideal for long-term wealth creation, diversified stock exposure.

- Cons: High market risk, volatility, not suitable for short-term goals.

Debt Funds

- Pros: Stable returns, low risk, great for short-term goals or emergency funds.

- Cons: Lower returns than equity, sensitive to interest rate changes.

Hybrid Funds

- Pros: Balances risk and return, diversified across asset classes, flexible allocation.

- Cons: Moderate returns compared to pure equity, can be complex to understand.

Index Funds/ETFs

- Pros: Low expense ratio, transparent, tracks market performance.

- Cons: Limited to index returns, no active management benefits.

Solution-Oriented Funds

- Pros: Goal-specific, disciplined investing with lock-in, diversified.

- Cons: Lock-in period reduces liquidity, moderate returns.

Fund of Funds

- Pros: Diversified across multiple funds, reduces selection hassle.

- Cons: Higher expense ratio, returns depend on underlying funds’ performance.

Practical Example: Equity vs Debt vs Hybrid

Let’s compare mutual fund types with a real-world scenario. Suppose you have ₹1 lakh to invest for 5 years. Here’s how different funds might perform:

Fund Type | Expected Annual Return | Risk Level | Ideal Investor |

Equity (Small Cap) | 12–15% | High | Aggressive, long-term investor |

Debt (Liquid Fund) | 5–7% | Low | Conservative, short-term investor |

Hybrid (Balanced Advantage) | 8–10% | Moderate | Balanced risk-taker |

Example: Investing ₹1 lakh in a small-cap fund with a 15% annual return could grow to ~₹2 lakh in 5 years (compounded). But a market crash could lead to losses. A liquid fund at 6% return might grow to ~₹1.34 lakh, with minimal risk.

Start Your Wealth Creation Journey with SIPs

Mutual funds are a powerful way to achieve your financial goals, whether it’s a dream vacation, retirement planning, or securing your child’s future. The types of mutual funds in India are versatile enough to suit every investor’s needs. But here’s the key: discipline matters. Starting a Systematic Investment Plan (SIP) lets you build wealth with small, regular investments. For example, a ₹5000 monthly SIP in an equity fund at 12% return could grow to ~₹50 lakh in 20 years!

With SEBI’s 2025 updates, mutual funds are more transparent and investor-friendly than ever. So why wait? Define your financial goals, assess your risk appetite, and start your mutual fund journey today.

Types of mutual funds in India, best mutual funds 2025, mutual fund types for beginners, SEBI mutual fund rules 2025.

Frequently Asked Questions (FAQs) About Mutual Fund Types

Got questions about mutual fund types? We’ve got answers! Here are some common queries to help you understand mutual funds better and choose the right one for your financial goals.

1. What are the different types of mutual funds in India?

Mutual funds in India are broadly categorized into five types by SEBI: Equity Funds (e.g., Large Cap, Mid Cap, Small Cap), Debt Funds (e.g., Liquid, Gilt), Hybrid Funds (e.g., Aggressive Hybrid, Balanced Advantage), Solution-Oriented Funds (e.g., Retirement, Children’s Funds), and Other Funds (e.g., Index Funds, ETFs, Fund of Funds). Each type serves different risk profiles and investment goals.

2. Which mutual fund type is best for beginners?

For beginners, Index Funds or Large Cap Funds are ideal. They offer low-cost, low-risk exposure to the market with steady growth potential. These mutual fund types track major indices like the Nifty 50 or invest in stable, well-established companies, making them beginner-friendly.

3. Are debt funds safer than equity funds?

Yes, Debt Funds are generally safer than Equity Funds because they invest in fixed-income securities like bonds and government securities, which have lower volatility. However, they offer lower returns compared to equity funds, which carry higher market risk but greater growth potential.

4. What’s the difference between hybrid and equity funds?

Equity Funds invest at least 65% in stocks, focusing on growth but with higher risk. Hybrid Funds balance equity (stocks) and debt (bonds) to offer both growth and stability. For example, Aggressive Hybrid Funds have 65–80% in equity, while Conservative Hybrid Funds prioritize debt (75–90%).

5. Can I invest in mutual funds for short-term goals?

Absolutely! For short-term goals (1–3 years), Liquid Funds or Short Duration Debt Funds are great choices. These mutual fund types provide stable returns and high liquidity with minimal risk, perfect for goals like buying a car or funding a vacation.

6. What are the benefits of SIPs in mutual funds?

A Systematic Investment Plan (SIP) lets you invest small amounts regularly, reducing the impact of market volatility. It’s a disciplined way to build wealth over time, especially in Equity Funds or Hybrid Funds. For example, a ₹5000 monthly SIP at 12% return could grow to ~₹50 lakh in 20 years!

7. How do SEBI’s 2025 rules affect mutual fund types?

SEBI’s 2025 updates ensure transparency in mutual fund types by enforcing clear naming, strict asset allocation rules (e.g., 65% equity for Equity Funds), and simplified regulations for passive funds like Index Funds and ETFs under the MF Lite framework. This makes it easier for investors to choose funds aligned with their goals.

8. Are sectoral or thematic funds risky?

Yes, Sectoral/Thematic Funds are high-risk because they focus on specific industries (e.g., IT, pharma) or themes (e.g., green energy). They can offer high returns if the sector performs well but are vulnerable to sector-specific downturns. They’re best for experienced investors with a high risk appetite.