Bank Account in India: From Basic to Advanced [2025 Mega Guide]

Confused about which bank account to open? Learn about types, features, documents, and the best salary accounts in India for 2025. Full expert guide.

Bank accounts are the foundation of personal finance in today’s world. Whether you’re a salaried employee receiving monthly income, a student handling pocket money, or a business owner managing transactions, a suitable bank account ensures the safety, convenience, and growth of your money.

Bank accounts are the foundation of personal finance in today’s world. Whether you’re a salaried employee receiving monthly income, a student handling pocket money, or a business owner managing transactions, a suitable bank account ensures the safety, convenience, and growth of your money.

In 2025, as India accelerates towards digital finance and smart banking, it’s crucial to choose the right type of bank account tailored to your lifestyle and financial goals.

This complete guide will walk you through:

- What exactly a bank account is (in simple terms)

- Types of bank accounts in India (with real-life examples)

- Documents you’ll need to open one

- Best salary accounts for salaried professionals

- Mistakes to avoid while choosing your first or next bank account

Whether you’re opening your very first account or optimizing your current one — this guide is designed for you.

Let’s dive in.

What is a Bank Account?

A bank account is a digital or physical record maintained by a bank that holds your money securely and allows you to deposit, withdraw, transfer, and grow your funds.

Think of it as your financial locker—but smarter.

In 2025, Indian banks offer accounts with:

- UPI integration for instant payments

- Auto sweep-in to fixed deposits

- Mobile banking apps with bill pay, investment, and loan features

- QR-based transactions

- Biometric and Aadhaar-based login security

Why You Need One:

- Safely store income or savings

- Make cashless transactions (NEFT, RTGS, UPI, IMPS)

- Access ATM withdrawals 24×7

- Receive government subsidies, tax refunds, and salary

- Start building a credit history for future loans

Whether you’re earning, studying, saving, or investing — a bank account is your gateway into India’s growing digital economy.

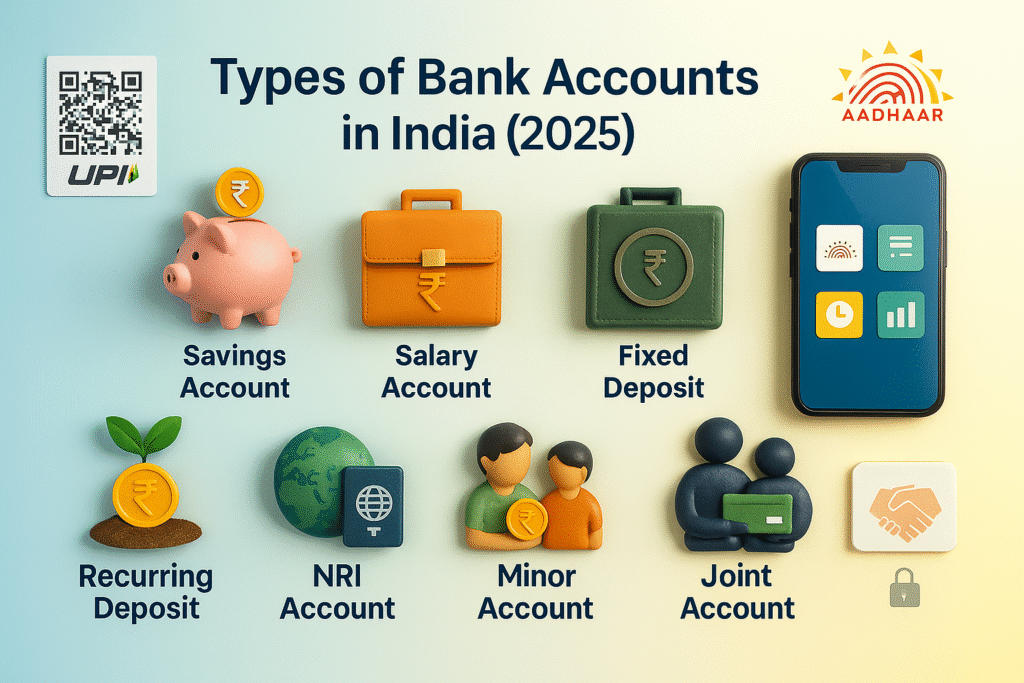

Types of Bank Accounts in India

Types of Bank Accounts in India

Here are the major types of accounts you can open in India, each with its own purpose, features, and eligibility:

1. Savings Account

This is the most common and beginner-friendly account. Designed for everyday users — salaried people, students, housewives, or retirees.

Features:

- Earn interest on balance (2.5% to 6.5% per annum)

- Free ATM card and cheque book

- Access to mobile & internet banking

- UPI-enabled

- Available as zero balance (like Kotak 811) or with minimum balance

Best For: General public, students, low-income users

2. Salary Account

A special type of savings account created for employees where the company credits monthly salary.

Features:

- Zero balance (no minimum monthly balance)

- Free debit card, cheque book, and digital banking

- Additional offers: cashback, lounge access, accidental insurance

- Gets converted to savings account if salary is not credited for 3 consecutive months

Best For: Private sector and government employees

3. Current Account

Built for businesses, self-employed professionals, and entrepreneurs who need to manage frequent, high-value transactions.

Features:

- No interest on balance

- High transaction limit (daily deposits/withdrawals)

- Overdraft and cheque facilities

- Often requires ₹10,000 to ₹25,000 average monthly balance

Best For: Business owners, shopkeepers, freelancers

4. Fixed Deposit (FD) Account

A fixed deposit (FD) is a time-bound investment account that gives you a higher return than a savings account by locking your money for a fixed duration.

Features:

- Tenure ranges from 7 days to 10 years

- Interest: 6% to 8.5% p.a. (as of 2025)

- Premature withdrawal may attract penalty

- Option to get monthly, quarterly, or maturity payout

- Tax-saving FD (5-year lock-in under Section 80C)

Best For: Risk-free investors, senior citizens, short-term savers

5. Recurring Deposit (RD) Account

An RD is like an FD but designed for monthly deposits. Ideal for salaried individuals saving slowly over time.

Features:

- Deposit a fixed amount every month

- Earn fixed interest (similar to FD)

- Tenure: 6 months to 10 years

- Premature closure allowed with conditions

Best For: Budget-conscious individuals saving for a goal (laptop, trip, wedding)

6. NRI Accounts (NRE/NRO/FCNR)

For Non-Resident Indians (NRIs), Indian banks offer special accounts based on currency, tax treatment, and fund repatriation.

| Account Type | Purpose | Repatriable? | Interest Taxable? |

| NRE | Foreign income | Yes | No |

| NRO | Indian income | Partially | Yes |

| FCNR | Foreign currency | Yes | No |

Best For: Indians working abroad, NRI students, foreign income earners

7. Minor & Joint Accounts

Used for financial planning with dependents or partners.

Minor Accounts:

- Can be opened by parents/guardians

- For kids under 18

- Limited features; conversion after 18

Joint Accounts:

- Two or more individuals share ownership

- Operated jointly or by either

- Common in families and business partnerships

Documents Required to Open a Bank Account in India

| Document Type | Examples |

| Identity Proof | Aadhaar, PAN, Passport |

| Address Proof | Electricity Bill, Aadhaar, Rent Agreement |

| Photographs | Passport-size (usually 1–2) |

| Income Proof | Salary slip or job letter (for salary account) |

| PAN-Aadhaar Link | Mandatory for most accounts |

How to Open a Bank Account in India

A. Online Method (2025-style)

- Choose bank app or website (e.g., Kotak 811, SBI YONO, ICICI iMobile)

- Enter Aadhaar & PAN for e-KYC

- Upload a selfie or do video KYC

- Account activated within minutes

- Virtual debit card + mobile banking access starts instantly

B. Offline Method (Still popular in tier-2/3 cities)

- Visit the nearest branch

- Fill account opening form

- Submit photocopies + originals

- In-person KYC

- Physical kit delivered within 7 days (card + passbook + cheque)

Salary Account vs Savings Account – Key Differences

| Feature | Salary Account | Savings Account |

| Balance Requirement | ₹0 (usually) | ₹5,000 – ₹10,000 |

| Eligibility | Salaried employee | Anyone |

| Benefits | High (cashback, insurance) | Moderate |

| Conversion Rule | Yes (after 3 months) | Not applicable |

| Overdraft Facility | Usually available | Only in premium accounts |

Best Salary Accounts in India [2025 Edition]

| Bank | Account Name | Highlights |

| HDFC Bank | Classic Salary | Cashback, EMI offers, UPI+Mobile access |

| ICICI Bank | Titanium Salary | Free debit card, rewards, lounge access |

| SBI | Corporate Package | Widest reach, personal banker in metro cities |

| Axis Bank | Prestige Salary | Credit card pre-approval, airport lounge |

| Kotak Bank | Edge Salary | Instant opening, zero balance, FD sweep-in |

Zero Balance Accounts Worth Knowing

- Kotak 811 – App-based, zero fees

- IDFC First – High interest, low charges

- Axis ASAP – Fully digital KYC

- Airtel Payments Bank – UPI + wallet-friendly

- Jan Dhan Yojana Account – For financial inclusion, rural users

Which Bank Account is Best for You? [Quick Recommendation]

Confused about which bank account to choose? Here’s a quick cheat sheet based on your profile and needs:

| User Type | Recommended Account Type | Best Bank (2025) |

| Salaried Employee | Salary Account | HDFC, ICICI, Axis |

| Student / Beginner | Zero Balance Savings | Kotak 811, IDFC First |

| Small Business Owner | Current Account | ICICI, Axis, SBI |

| Frequent Saver | Fixed Deposit + Savings Combo | SBI, HDFC, ICICI |

| Goal-Based Saver | Recurring Deposit + UPI Wallet | Axis, Canara Bank, Post Office |

| NRI | NRE/NRO/FCNR Account | SBI, ICICI, HDFC |

| Minor / Teen Account | Minor Savings Account | HDFC Kids Advantage, SBI Pehla Kadam |

Expert Tip:

Start with a zero-balance savings account, understand digital banking, and upgrade as your income grows.

Mistakes to Avoid While Opening a Bank Account

Even smart people make basic mistakes — here’s what not to do:

- Ignoring hidden charges (SMS fees, ATM withdrawal limits)

- Not checking if the account offers a mobile app or UPI access

- Opening a current account without a business need

- Not linking PAN & Aadhaar — leads to a frozen or blocked account

- Choosing a bank with no local branch or ATM

- Avoiding FD-linked savings account (sweep-in options give better returns)

Frequently Asked Questions (FAQs)

1. Can I open more than one bank account in India?

Yes, you can open multiple bank accounts across different banks. In fact, it’s smart to diversify between savings, salary, and FD accounts.

2. What happens if I don’t maintain the minimum balance?

Banks charge non-maintenance fees (₹150–600/month) depending on the shortfall. Go for a zero-balance account if you want to avoid this.

3. Which bank account gives the best interest rate in 2025?

Currently, IDFC First Bank and AU Small Finance Bank offer up to 7% interest on savings. Kotak 811 and Airtel Payments Bank also offer high returns for digital users.

4. Can NRIs open joint accounts with residents in India?

Yes, NRIs can open NRO joint accounts with resident Indians. NRE and FCNR accounts must be held individually or with another NRI.

5. Is online bank account opening safe in 2025?

Absolutely. Most leading banks use video KYC, biometric verification, and encrypted apps to protect user data. Just ensure you’re on the official website or app.

Bank accounts today are more than just money holders — they are your entry gate to digital India.

Whether you’re a salaried professional, entrepreneur, student, or NRI — there’s a smart account made just for you.

Choose wisely. Start simple. Compare smartly.

And remember:

- Start with a zero-balance savings account

- If salaried, upgrade to a benefit-rich salary account

- Use FD + RD for low-risk savings

- Prefer banks that offer a great mobile experience and nationwide ATM access

Related Guides

[Best Zero Balance Savings Account in India – Updated List]

[Best Credit Card for Salaried Professionals in India – 2025]

[How to File Income Tax Return Online in India – Step by Step]

[Top Fixed Deposit Schemes in India for Monthly Interest – 2025]